|

|

| dispatch from ces |

|

|

| today’s must read |

|

|

| More from AdExchanger |

|

Precise TV Secures $26 Million PE Investment |

|

Meet AdGood, A Nonprofit That Helps Other Nonprofits Buy CTV Ads |

|

|

Here’s today’s AdExchanger.com news round-up... |

|

CES Magic

The Mouse House is making noise during the Consumer Electronics Show (CES) in Las Vegas this week.

On Monday, Disney launched a new ad product to combat data fragmentation. The next day, it announced biddable sports deals and an ad certification program for live sports. Its annual Tech and Data Showcase happens later today (and AdExchanger will be there).

Like other legacy broadcasters, Disney is juggling streaming gains with linear losses while trying not to lose market share to pure-plays like Netflix, Amazon Prime Video and Apple TV. Broadcasters are prioritizing live sports to attract both traditional advertisers and performance marketers, which are choosier about where they invest their paid media budgets and tend to focus on the lower funnel.

Disney’s latest sports-focused offering should make it easier for advertisers to capitalize on exciting or unexpected moments in a game, such as overtime, Adweek reports. Its launch partners are The Trade Desk, Google’s DV360, Yahoo DSP and Magnite.

But Disney isn’t the only broadcaster hoping live sports will score them points with buyers. NBCUniversal made most of its live sports inventory biddable in 2023, which fueled the appetite for programmatic during the 2024 Paris Olympics.

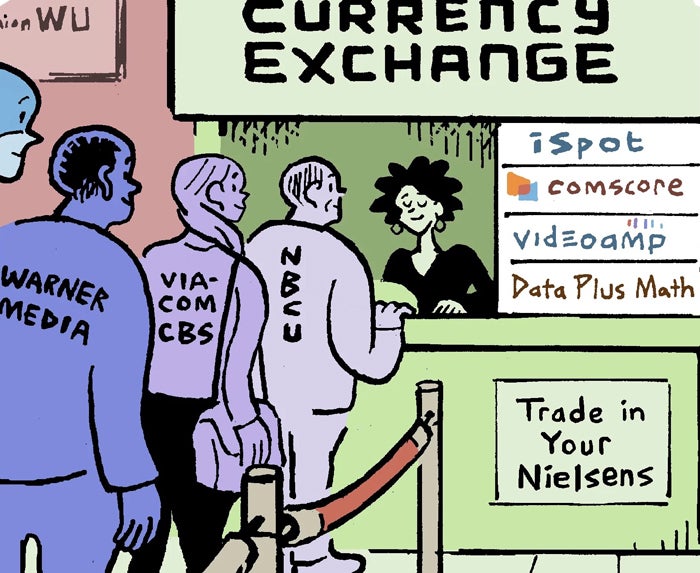

Currencies Collide At CES

Paramount just renewed its contract with VideoAmp, one of Nielsen’s top video measurement rivals.

But this partnership is more than just another glitzy announcement timed to CES in Las Vegas (although it’s also very much that). The deal represents the next phase of TV measurement infighting.

When their contract expired in the fall, Paramount pointed the finger at Nielsen, claiming the ratings provider’s services are unsustainably costly.

Then, a few weeks ago, Nielsen removed Paramount’s TV data from its service that tracks ad transactions, spurring buyer frustration and a heated debate on LinkedIn over the rationale behind the decision.

Fast-forward to Monday, and VideoAmp, spotting an opportunity, announced free access to its national linear content ratings dashboard for agencies and advertisers through the end of March. That offer could help the measurement challenger attract new clients among buyers and brands that are fed up with Nielsen, Ad Age reports.

No doubt Comscore and iSpot – both of which have a presence at CES – are also using the conference as an opportunity to book meetings and demos with as many buyers as possible.

May the best (alternative?) currency win.

What’s In A Name?

Sports leagues are growing, and new sports are popping up everywhere.

That’s a good thing. Except naming a team has become a major hassle. Trademark and IP infractions are now so easily identified programmatically (as in, automatically by software, not necessarily ad tech) and then litigated that snappy, chantable names are hard to come by, reports The Wall Street Journal.

Another unexpected issue is how widely any brand or IP is now licensed and distributed across categories.

Businesses or organizations in a region or an adjacent category would typically sue to block a team name. A Maryland Ravens pro rugby team, for example, would obviously conflict with the NFL’s Baltimore Ravens.

But is the word “Raven” forbidden everywhere?

And now that brands and influencers license their names and trademarks to practically anything – often regardless of any logical adjacency – practically every zingy or compelling one-letter word is already claimed.

“So you’re looking to search and clear trademarks for every category under the sun, as opposed to a small niche of goods and services,” says Laurie Marshall, a lawyer who works with sports leagues and businesses.

Guess a team can always go the Boaty McBoatface route – but not with that name, specifically. It’s trademarked.

But Wait! There’s More!

Meta removes third-party fact-checking from Facebook and Instagram and will shift to community notes. [WSJ]

Meanwhile, fact-checkers that partner with Meta claim they were blindsided by the platform’s plan to crowdsource content moderation. [Wired]

Discovery+ raises subscription fees for both ad-free and ad-supported plans by $1 per month. [IndieWire]

Hackers claim they’ve breached location data provider Gravy Analytics – which recently settled with the FTC over alleged privacy violations – and are threatening to leak stolen data. [404 Media]

Amazon Autos introduces an “Add to Cart” option for Hyundai vehicles. [MSN]

You’re Hired

Telly, the startup that’s giving away TVs in exchange for viewers sharing personal data, just hired Uber vet Seho Lee as its first advertising president. [Business Insider]

Publicis poaches Omnicom’s Geoff Calabrese to be the agency’s new chief commercial officer. [Ad Age]

Maggie Zhang rejoins Amazon Ads after a stint at NBCUniversal, this time as head of global video measurement GTM. [LinkedIn post]

Comcast promotes James Borow to VP of product and engineering for the telco’s new self-serve ad platform, Universal Ads. [LinkedIn post]

Zeta Global hires Pamela Lord as president of CRM. [release]

WildBrain, a family-focused entertainment company, hires Emma Witkowski as VP of media solutions. [release]

| This week’s adexchanger podcasts |

|

|

|

|

|