Fine With Flat? Comcast Lost 26K Broadband Subscribers in Q4 ... Why Investors Are OK With That

For the first time ever, Comcast reported a quarterly customer loss for its core wireline connectivity business. Wall Street's surprising reaction? Meh

Sometime around late 2021, when investors started to suspect that Comcast and Charter couldn't maintain the incendiary paces of their pandemic-era broadband growth, the share prices of the two cable companies started to crater.

Comcast, for example, only trades at around two-thirds the price it did on August 1 of 2021.

So it was a bit of a surprise Thursday when Comcast revealed that it had, for the first time in memory, lost broadband subscribers in a quarter, 26,000 of them … but a hit to its stock price never came.

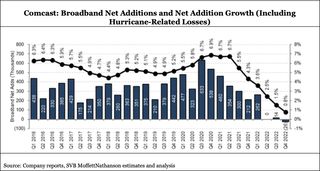

Indeed, Comcast's Nasdaq price remained largely flat throughout Thursday, even though its core connectivity business -- which grew by nearly 2 million subscribers in 2020 -- was largely flat itself in 2022, growing at just 0.8%.

Also read: Comcast Cord-Cutting Accelerated to Record High 11.2% in 2022

As analyst Craig Moffett asked in the title of his report on Comcast’s fourth-quarter earnings, “Is Flat the New Up?”

To Moffett's thinking, there are a lot of factors working against Comcast and Charter in their quest to reignite broadband subscriber growth. These factors include the competitive undermining currently happening as a result of T-Mobile and Verison's highly successful fixed wireless access launches; the proliferation of fiber-to-the-home by AT&T and other telcos; and the simple truth that America's high-speed internet market is largely saturated.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In its Q4 presentation Thursday, Comcast said there is something it can do about saturation — rural edge-outs, the company said, could deliver it up to 1 million additional passings over the next several years.

Meanwhile, the company is embarking on a quest to festoon its entire footprint with availability to multi-gigabit speeds — a wherewithal not currently possible with 5G FWA.

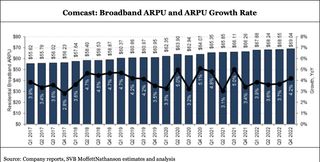

Despite these efforts, Moffett doesn't see substantially reinvigorated customer growth happening soon. And that shouldn't matter, he said, as long as Comcast can grow its average revenue per user (ARPU) on its broadband customers.

Customer growth expectations “are now where they need to be,” he said, and “broadband ARPU is now the most important metric.”

Also convincing equity analysts including Moffett that Comcast is OK going forward with flat wireline broadband growth: record quarterly customer growth for Xfinity Mobile, which added 365,000 lines in Q4.

Here are two MoffettNathanson charts from today’s report, one summarizing Comcast's slowing broadband customer growth trajectory, the other showcasing its growing ARPU on high-speed internet services. ■

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!