“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Cary Lawrence, CEO of customer data and analytics platform Decile.

We’ve seen an absolute explosion in independent ecommerce entrepreneurship over the past year. But the industry is confronting headwinds on two fronts: a dramatic impact on measurement caused by Apple’s iOS 14.5 and acquisition costs that continue to increase unabated.

Merchants know that profitable growth is key to their success, and measuring customer acquisition costs (CAC) is a foundation for that growth. So let’s review a few ways to calculate CAC, identify some key challenges facing ecommerce businesses and highlight a new approach.

What Is CAC?

Let’s start with the basics. Customer Acquisition Cost (CAC) is a metric that describes how much it costs to use paid marketing to acquire a new, paying customer. It’s used in all sorts of verticals – from B2C retail to B2B software as a service (SaaS) – to understand a firm’s readiness to scale acquisition costs profitably.

It’s worth decomposing the formula because, while it appears simple, there’s a fair amount of nuance.

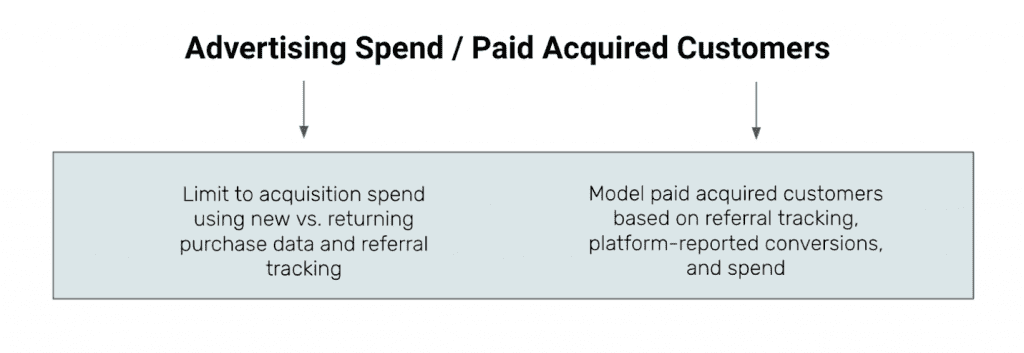

Advertising Spend / Paid Acquired Customers

In order to drive key business decisions, your methodology has to account for questions such as:

- How to measure true acquisition costs?

- How to define paid, net-new customers?

- How to account for (and attribute the cost associated with) the influence of your paid marketing on customers who appear to be driven outside of those channels?

The Retail Challenge

Unlike firms with recurring and predictable lifetime value (LTV ), such as subscription media companies, retail businesses are constantly fighting for the next purchase – especially from customers they’ve already acquired. That means a material amount of their marketing budget is going toward incremental purchases, including retention and reengagement. Recent attribution changes; myriad email, sms and organic marketing campaigns; and Excel-based analytics are other factors that make it challenging to calculate CAC.

That’s led to a whole range of techniques that merchants use, not all of which are particularly effective in answering the questions above.

Measurement Approaches

Let’s first look at a handful of these conventional methods.

Cost of Transaction

The simplest approach is what we call Cost of Transaction. This metric is most similar to an ROAS (return on ad spend) metric – i.e., it takes your total marketing spend and divides it by the total number of conversions, not customers.

Key Limitation: This is helpful to simplify the complex relationship between cross-campaign marketing costs and new purchases, but it does not represent customer acquisition costs.

CAC, Simple

When it comes to CAC, the most basic approach is to take your total marketing spend and divide it by the number of new customers over a particular period. We can call this metric CAC, Simple.

Key Limitation: It does not separate direct and organically acquired customers vs. those driven by your paid marketing. Nor does it adjust your total marketing costs to consider only acquisition spend.

CAC, Simple – Paid Channels

Many merchants understand this limitation and thus try to improve upon CAC, Simple by taking total marketing spend and dividing it by the number of new customers acquired via paid channels.

Key Limitation: This will overstate your true CAC because it is not accounting for all customers influenced by your marketing – only those with a post-click referral.

CAC, Modeled

A preferred approach incorporates all of the key signals – post-impression and post-click referrals and acquisition-focused marketing costs.

When we combine the best of people-based analytics, multi-touch attribution and marketing mix modeling – and apply them to the CAC domain – we end up with a 21st century caliber customer cost analytics framework that is accurate, actionable and adaptable to the new digital ecosystem.

Wrapping It Up

Let’s just acknowledge that CAC has a deceptively simple formula, with a number of interesting nuances to consider. While certain solutions are often sufficient for businesses with simpler marketing plans, ecommerce retail merchants should look beyond last-touch attribution and adjust costs to account for concurrent retention efforts.

Customer-cost analytics is an extremely important part of profitable growth. Getting to the right CAC methodology will pay dividends as you optimize acquisition, retention, products and pricing – and it requires looking beyond your business’s conventional approach.